Driven by the Inflation Reduction Act, North America becomes fastest growing region for new battery factories, says CEA

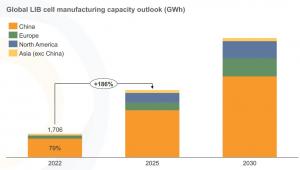

China remains the leading manufacturing hub for battery cells, but its share is likely to decline in coming years; Europe faces delays and cancellations

DENVER, COLORADO, UNITED STATES, May 31, 2023/EINPresswire.com/ -- By the end of 2022, North America had become the fastest growing regional market for planned new battery cell manufacturing plants, according to Clean Energy Associates’ latest Energy Storage System Supplier Market Intelligence Program report.Much of this growth is attributable to incentives provided by the U.S. Inflation Reduction Act.

Europe witnessed delays and cancellations of several planned production facilities, due in large part to high energy prices and more attractive policy support from other regional markets, said CEA.

Clean Energy Associates’ Energy Storage System (ESS) Supplier Market Intelligence Program (SMIP) offers twice-a-year independent, unbiased market intelligence about the world’s top lithium-ion cell manufacturers and energy storage system integrators.

Access to timely, accurate information is strategically important, and its absence can create sizable risk. The program brings together objective, high-quality, multi-sourced, and verified data on the highly dynamic storage industry. Biannual reports include an overview of each supplier’s products, capacity, product development, and industry positioning, to help clients assess the risks and opportunities associated with many potential vendors and products.

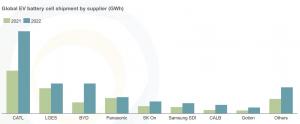

Increased market fragmentation is expected, as the expansion of the ESS market will enable the growth of Tier II/III suppliers currently unable to deliver scale for EV buyers in particular.

Examples from the current project pipeline include:

● American Battery Factory (ABF), founded by Lion Energy, will build a network of LFP battery factories in the U.S., with its first factory in Tucson, Arizona. The company plans to build LFP battery cells for both EV and ESS applications.

● California-based Amprius Technologies will build a 5 GWh factory (in phases) in Colorado. The first phase, with 0.5 GWh capacity, will come online by 2025.

● Canada’s battery manufacturer Electrovaya will build the EV battery plant in Chautauqua County with around 1 GWh capacity.

● Envision AESC plans to set up its second EV battery factory in the U.S. in partnership with BMW. The factory will be set up in South Carolina with an annual capacity of 30 GWh.

● In partnership with CATL, Ford will set up a 35 GWh LFP cell production facility in Michigan.

● FREYR will parallel develop its Giga America and Giga Arctic to gain U.S. IRA incentives. Tax credits offered through the IRA would allow FREYR to receive $37 million/GWh of capacity installed in the U.S.

● And many more…

The executive summary of the report can be downloaded for free and a complete copy can be requested for purchase here.

Allison Lenthall

Clean Energy Associates

+1 202-322-8285

email us here

Visit us on social media:

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.